The Deal That You Didn’t Know Could Happen: Oil’s Seasonal Tailwind Amid Grand Bargain Speculation

Image Source: Unsplash

Video Length 00:01:56

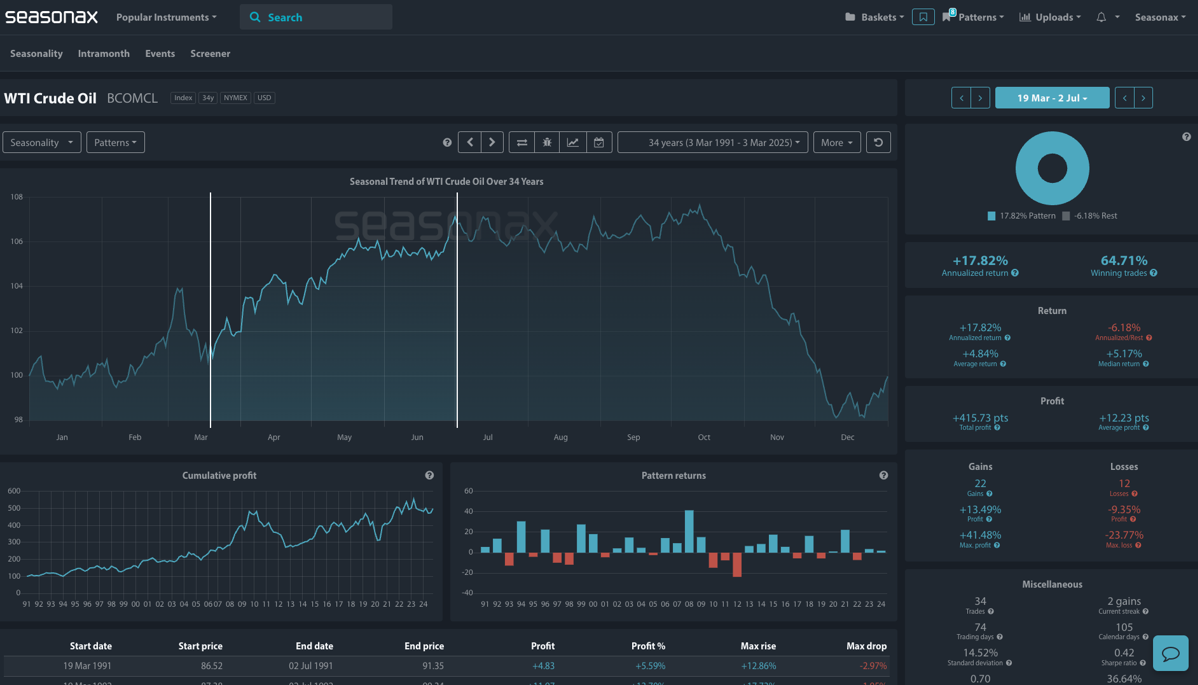

- Instrument: WTI Crude Oil (BCOMCL)

- Average Pattern Move: +4.84%

- Timeframe: March 19 – July 2

- Winning Percentage: 64.71%

You may not realize it, but oil markets could be on the verge of a geopolitical shake-up as speculation mounts over a potential oil deal being struck between the US, Saudi Arabia, and Russia. With US energy independence at a record high and the Trump administration seeking lower oil prices, discussions about a new coordinated oil strategy are gaining traction. Meanwhile, seasonal patterns show a historically strong period for crude oil prices from mid-March to early July, a trend we want to analyze in more detail.

Seasonal Trends: Oil’s Spring Surge

The chart shows you the typical price behavior of WTI crude oil from March to early July over the past 34 years. This period has historically seen an annualized return of +17.82%, with oil prices rising 64.71% of the time. The seasonal upside is driven by increased demand ahead of the summer driving season.

(Click on image to enlarge)

The ‘Grand Bargain’ Speculation: Will Oil Markets Shift?

There is growing chatter about the potential US cooperation with Saudi Arabia and Russia on stabilizing oil prices which is raising questions about the future of global energy policy. While such a deal remains speculative, Trump’s past engagement with OPEC+ and Russia in 2020 suggests renewed collaboration is not out of the question. A coordinated effort to manage supply and prices could reinforce seasonal bullishness in crude, particularly if Saudi Arabia and Russia adjust production levels in response.

Technical Perspective

From a technical standpoint US oil is sat in a key support zone around $66. This would be a potential area for any speculative dip buyers to enter, with stops under $64.

(Click on image to enlarge)

Trade risks

Despite the strong seasonal trend, crude oil remains highly sensitive to geopolitical risk, economic data, and supply shocks. Unexpected shifts in US energy policy, disruptions in the Middle East, or weaker-than-expected global demand could weigh on prices. Additionally, OPEC+ output decisions remain a key wildcard, particularly if producers prioritize market share over price stability.

More By This Author:

Shell’s Executive Shake-Up And Seasonal Strength – A Buying Opportunity?

Room For More EURUSD Upside

Will The S&P 500 Rally Post-NFP In Line With History?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more